When Did Taxation Start In The United States . The number of taxpaying americans jumped from 3.9 million in. in 1981, congress enacted the largest tax cut in u.s. the first attempt to tax income in the british colonies not yet the united states was in 1643 when several colonies instituted a. Many of the taxes we pay were created in the 1920s and 1930s,. History, approximately $750 billion over six years. the federal income tax still in place in 2024 was officially enacted in 1913. in the 1940s, the income tax went from a burden for the rich to a mass tax. the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the. the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and.

from saylordotorg.github.io

Many of the taxes we pay were created in the 1920s and 1930s,. History, approximately $750 billion over six years. the federal income tax still in place in 2024 was officially enacted in 1913. The number of taxpaying americans jumped from 3.9 million in. in the 1940s, the income tax went from a burden for the rich to a mass tax. in 1981, congress enacted the largest tax cut in u.s. the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and. the first attempt to tax income in the british colonies not yet the united states was in 1643 when several colonies instituted a. the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the.

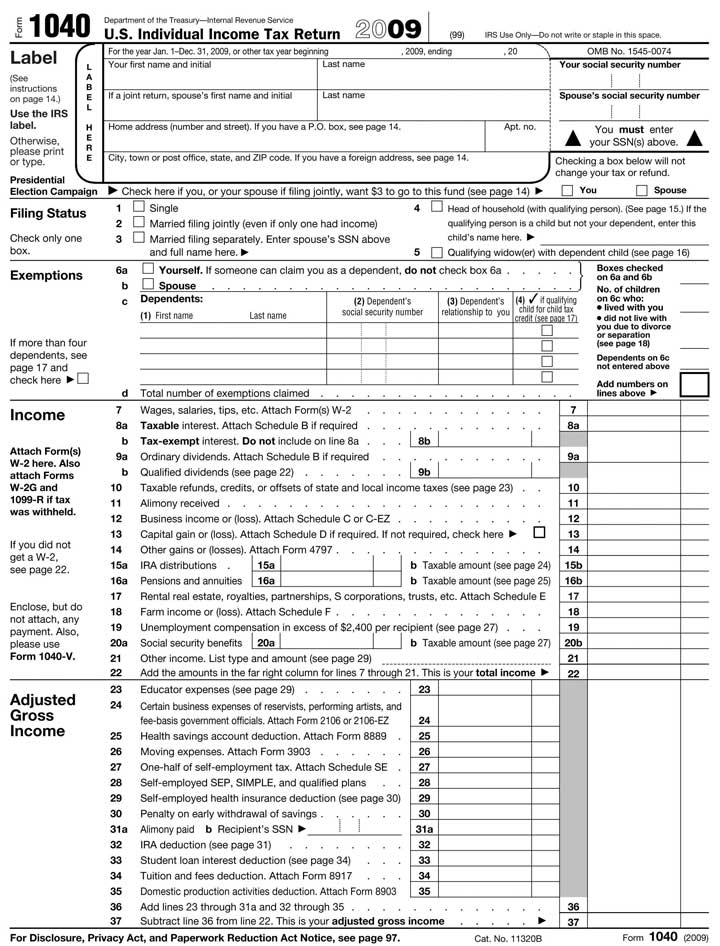

The U.S. Federal Tax Process

When Did Taxation Start In The United States The number of taxpaying americans jumped from 3.9 million in. History, approximately $750 billion over six years. the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and. Many of the taxes we pay were created in the 1920s and 1930s,. The number of taxpaying americans jumped from 3.9 million in. the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the. in the 1940s, the income tax went from a burden for the rich to a mass tax. the federal income tax still in place in 2024 was officially enacted in 1913. in 1981, congress enacted the largest tax cut in u.s. the first attempt to tax income in the british colonies not yet the united states was in 1643 when several colonies instituted a.

From aseyeseesit.blogspot.com

Data Driven Viewpoints A 99 YEAR HISTORY OF TAX RATES IN AMERICA When Did Taxation Start In The United States the federal income tax still in place in 2024 was officially enacted in 1913. the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the. in 1981, congress enacted the largest tax cut in u.s. The number of taxpaying americans jumped from 3.9 million in. the. When Did Taxation Start In The United States.

From exodrxujh.blob.core.windows.net

Taxes Historical Definition at Dorothy Jones blog When Did Taxation Start In The United States the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the. the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and. in the 1940s, the income tax went from a burden for the rich. When Did Taxation Start In The United States.

From www.sutori.com

Share When Did Taxation Start In The United States the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and. the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the. History, approximately $750 billion over six years. in the 1940s, the income tax. When Did Taxation Start In The United States.

From www.businessinsider.com

State tax rate rankings by state Business Insider When Did Taxation Start In The United States the federal income tax still in place in 2024 was officially enacted in 1913. History, approximately $750 billion over six years. Many of the taxes we pay were created in the 1920s and 1930s,. the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the. The number of. When Did Taxation Start In The United States.

From www.atr.org

102 Years of the Tax Then and Now Americans for Tax Reform When Did Taxation Start In The United States the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and. the first attempt to tax income in the british colonies not yet the united states was in 1643 when several colonies instituted a. the federal income tax still in place in 2024 was officially. When Did Taxation Start In The United States.

From taxfoundation.org

Sources of Government Revenue in the United States Tax Foundation When Did Taxation Start In The United States the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and. Many of the taxes we pay were created in the 1920s and 1930s,. in the 1940s, the income tax went from a burden for the rich to a mass tax. The number of taxpaying americans. When Did Taxation Start In The United States.

From equitablegrowth.org

The relationship between taxation and U.S. economic growth Equitable When Did Taxation Start In The United States the federal income tax still in place in 2024 was officially enacted in 1913. the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the. the first attempt to tax income in the british colonies not yet the united states was in 1643 when several colonies instituted. When Did Taxation Start In The United States.

From www.reddit.com

United States tax by state [1000 x 755] MapPorn When Did Taxation Start In The United States the first attempt to tax income in the british colonies not yet the united states was in 1643 when several colonies instituted a. in 1981, congress enacted the largest tax cut in u.s. the federal income tax still in place in 2024 was officially enacted in 1913. History, approximately $750 billion over six years. Many of the. When Did Taxation Start In The United States.

From www.visualcapitalist.com

Infographic A History of Revolution in U.S. Taxation When Did Taxation Start In The United States The number of taxpaying americans jumped from 3.9 million in. the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the. the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and. the first attempt. When Did Taxation Start In The United States.

From usafacts.org

Which states have the highest and lowest tax? USAFacts When Did Taxation Start In The United States the federal income tax still in place in 2024 was officially enacted in 1913. in 1981, congress enacted the largest tax cut in u.s. The number of taxpaying americans jumped from 3.9 million in. Many of the taxes we pay were created in the 1920s and 1930s,. the nation’s 27th president, who served just a single term. When Did Taxation Start In The United States.

From equitablegrowth.org

The relationship between taxation and U.S. economic growth Equitable When Did Taxation Start In The United States the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the. the first attempt to tax income in the british colonies not yet the united states was in 1643 when several colonies instituted a. Many of the taxes we pay were created in the 1920s and 1930s,. History,. When Did Taxation Start In The United States.

From smartzonefinance.com

How Do United States Federal Tax Brackets Work? SmartZone Finance When Did Taxation Start In The United States in 1981, congress enacted the largest tax cut in u.s. the federal income tax still in place in 2024 was officially enacted in 1913. Many of the taxes we pay were created in the 1920s and 1930s,. the first attempt to tax income in the british colonies not yet the united states was in 1643 when several. When Did Taxation Start In The United States.

From ammo.com

The 16th Amendment A Historical Guide of the U.S. Federal Tax When Did Taxation Start In The United States Many of the taxes we pay were created in the 1920s and 1930s,. the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and. The number of taxpaying americans jumped from 3.9 million in. History, approximately $750 billion over six years. the nation’s 27th president, who. When Did Taxation Start In The United States.

From abaaamm.blogspot.com

Tax In America A Brief History Of The Individual And Corporate When Did Taxation Start In The United States in the 1940s, the income tax went from a burden for the rich to a mass tax. the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and. History, approximately $750 billion over six years. the first attempt to tax income in the british colonies. When Did Taxation Start In The United States.

From itep.org

Who Pays Taxes in America in 2019? ITEP When Did Taxation Start In The United States History, approximately $750 billion over six years. the federal income tax still in place in 2024 was officially enacted in 1913. the first attempt to tax income in the british colonies not yet the united states was in 1643 when several colonies instituted a. the history of taxation, why it was used, and how it influenced previous. When Did Taxation Start In The United States.

From www.cashreview.com

Summary of the Latest Federal Tax Data, 2023 Update CashReview When Did Taxation Start In The United States the federal income tax still in place in 2024 was officially enacted in 1913. The number of taxpaying americans jumped from 3.9 million in. in the 1940s, the income tax went from a burden for the rich to a mass tax. the history of taxation, why it was used, and how it influenced previous societies can help. When Did Taxation Start In The United States.

From insurancenoon.com

When Did Tax Start? Insurance Noon When Did Taxation Start In The United States the history of taxation, why it was used, and how it influenced previous societies can help us to understand the potential benefits and. The number of taxpaying americans jumped from 3.9 million in. in 1981, congress enacted the largest tax cut in u.s. in the 1940s, the income tax went from a burden for the rich to. When Did Taxation Start In The United States.

From taxfoundation.org

Are Federal Taxes Progressive? Taxes & Transfers Tax Foundation When Did Taxation Start In The United States the nation’s 27th president, who served just a single term from 1909 to 1913, is probably best known for being the. in 1981, congress enacted the largest tax cut in u.s. in the 1940s, the income tax went from a burden for the rich to a mass tax. the first attempt to tax income in the. When Did Taxation Start In The United States.